Gemstone Investment

As a multi-family office, Shanos Group specializes in providing our clients with support and opportunities for their investments. Gemstones, also known as colored stones, are increasingly recognized as an alternative investment that adds diversification to a portfolio while carrying lower risks compared to other assets like gold, bonds, or stocks. This is due to their market stability and significant intrinsic value. Their rarity, brilliance, and steady demand make colored stones a compelling option for long-term investment.

Historically, many noble families have preserved their wealth through collections of jewelry and precious stones. During uncertain times or crises, these jewels have consistently served as a stable form of currency. As one of the oldest commodities in existence—dating back over 5,500 years—gemstones carry more historical and cultural significance than many other investment choices. Their appeal lies in their inherent qualities: stability, compactness, ease of storage, and exceptionally high value relative to other known investments. The rarity and increasing demand for these stones continue to drive up prices, offering protection against inflation.

Benefits of Colored Stone Investment

- Rising Value: As gemstone mines deplete, the value and rarity of colored stones continue to increase.

-

Portability: They are easy to carry, store, and transport.

-

High Liquidity: There is always a buyer for colored stones.

-

Authenticity Assurance: Unlike other aesthetic investments, gemstones come with internationally recognized certificates from gemological institutes, reducing the risk of purchasing fakes.

-

Asset Protection: They help preserve value over time.

-

Generational Wealth: They can be passed down to future generations.

International Trade: Colored stones are traded globally.

Types of Colored Stones for Investment

Rubies

Rubies are not only the second hardest mineral in the world, rivaling diamonds, but they are also rarer. The most coveted and highly valued rubies feature a rich pigeon blood hue.

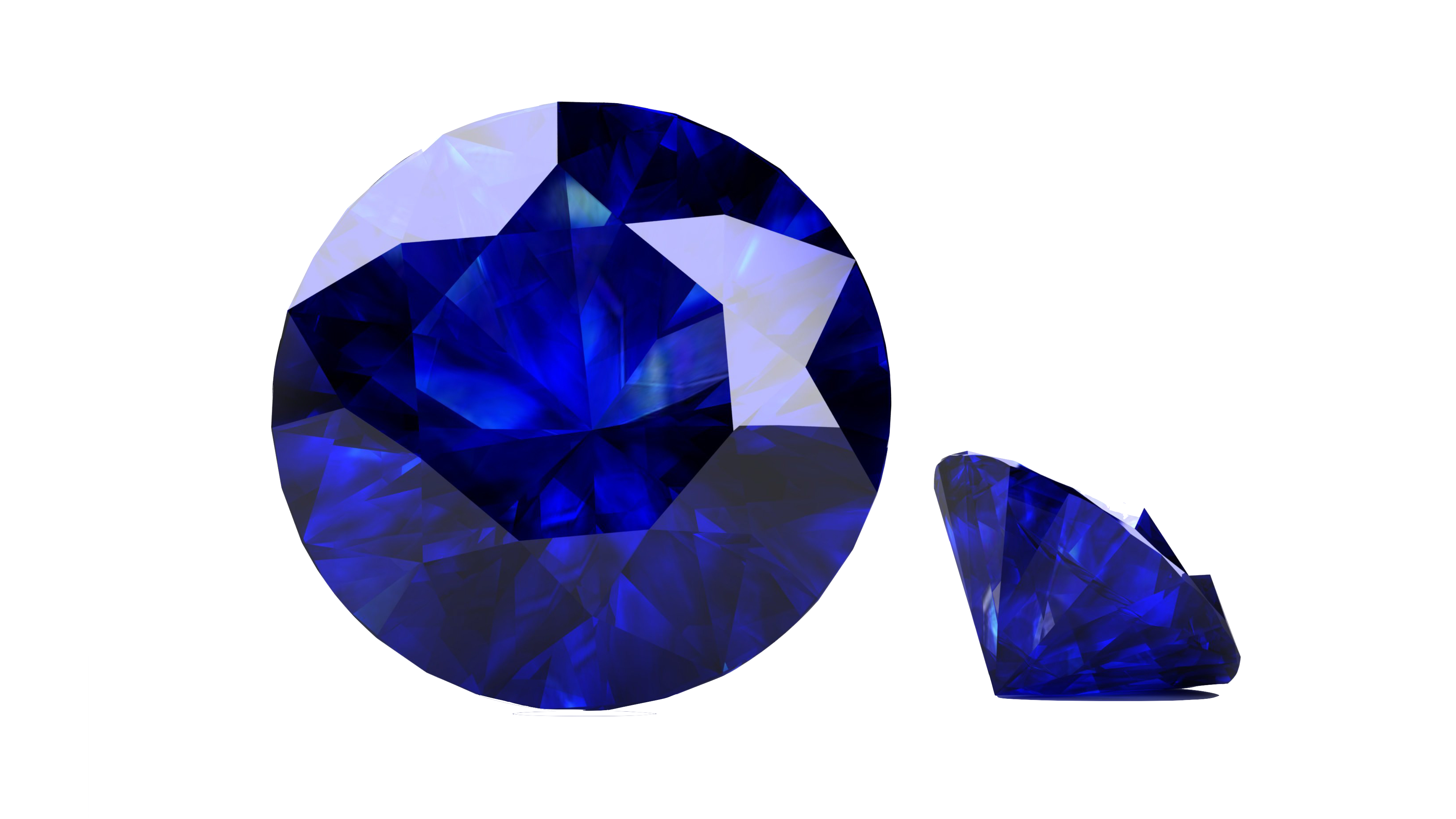

Sapphire

Sapphires, famous for their blue color, are the second most popular colored stone among investors after rubies. Although they can be found in every color of the rainbow, the royal blue sapphire commands the highest value, with investment-grade blue sapphires reaching prices of up to $100,000 USD per carat.

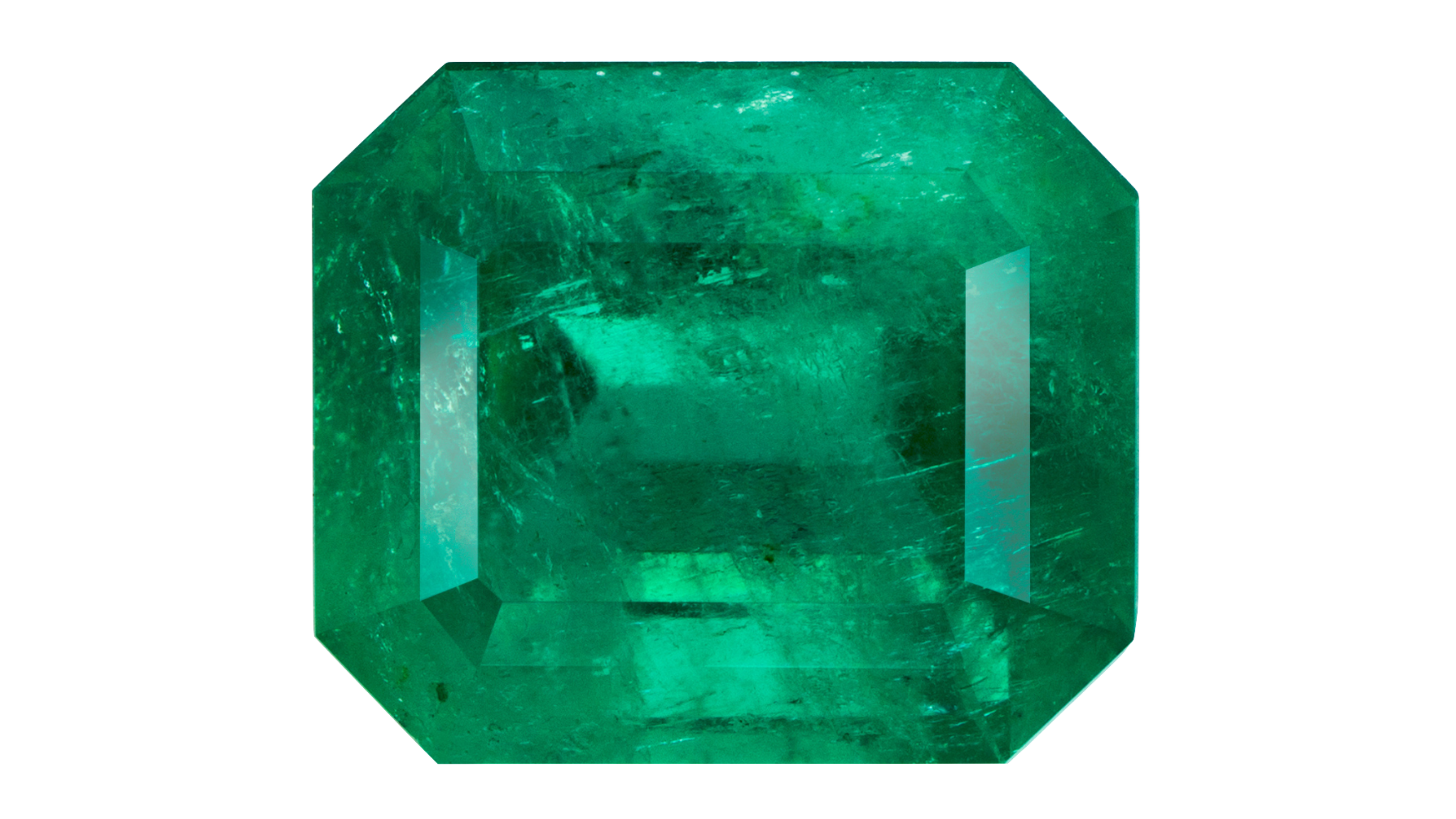

Emerald

Emeralds, when not being used for whimsical purposes like in a certain fictional city, are highly regarded as investment stones. Their value increases with the vibrancy of their green color and the number of inclusions they have; fewer inclusions mean greater value. As green emeralds become increasingly rare, they attract higher prices, with a notable sale in 2017 fetching $300,000 USD per carat.

Spinel

Spinels can be colorless, but impurities give rise to a stunning array of colors. Bright red, hot pink, and fiery orange spinels are currently trending, thanks to the popularity of candy-colored designer jewelry. In recent years, prices for spinels have surged, particularly for vibrant neon pink-red varieties.

Shanos

Over the last 20 years, Shanos prices have consistently risen, driven by their incredible rarity. Exhibiting lush deep green colors, Shanos rank among the rarest of all garnets, outshining emeralds in rarity, clarity, and brilliance. Currently, Shanos cost above $10,000 USD per carat and are expected to only continue growing in price.

Paraiba Tourmaline

Tourmalines showcase a wide spectrum of colors, but the Paraiba tourmaline stands out as particularly desirable. These gems exhibit striking turquoise or blue shades and are considered the most valuable type of tourmaline. The price of top-quality Paraiba tourmalines, which depend on their strong blue-green color, clarity, and a minimum weight of 5 carats, can reach up to $100,000 USD per carat. Over the past 40 years, the average price of these gems has increased by 10,000%.

Key Factors to Consider When Investing in Colored Stones

When considering colored stones for investment, it’s essential to prioritize those with minimal to no enhancements. For instance, while rubies and sapphires are often heated and emeralds are typically oiled, any enhancement can diminish the stone’s value. Thus, investing in stones with little to no treatment is generally more advantageous.

Diamonds vs. Colored Stones

Historically, diamonds have held a prominent place in popular culture, famously associated with phrases like “diamonds are a girl’s best friend” and “a diamond is forever.” However, these phrases are losing their relevance as diamonds are no longer perceived as rare.

The market for artificial diamonds is expanding, making them nearly indistinguishable from natural diamonds. Over the past year, natural diamond prices have dropped significantly, between 18% and 23%, as lab-grown diamonds, which are chemically, physically, and optically identical to natural ones, are sold at a fraction of the cost. In 2018, the Federal Trade Commission even classified lab-grown diamonds as legitimate diamonds, further decreasing demand for natural ones.

In contrast, colored stones are experiencing a continuous increase in demand and price. This trend is driven by the discovery and depletion of many mines, resulting in the growing rarity of colored stones. While the rise of synthetic diamonds has impacted the natural diamond market, it has not similarly affected colored stones. The production of artificial colored gemstones began in the late 1800s, yet this has not impacted the value of authentic colored stones, thanks to their inherent rarity.

Furthermore, colored stones, like rubies and sapphires, tend to be rarer than diamonds in perfect quality, which is reflected in their higher price per carat—often costing between $100,000 to $200,000 USD more than white diamonds. Therefore, choosing colored stones for investment is often superior to diamonds, as they avoid inflation, face no competition from synthetics, and are recognized for their greater rarity.

Colored Diamonds

While colorless diamonds are seeing a decline in value, colored diamonds, or “fancy diamonds,” occupy a unique market. These diamonds are incredibly rare and do not come from conventional mines. They showcase vibrant colors such as pink, orange, blue, and yellow. Although yellow diamonds are visually appealing, they lack the rarity of red, blue, green, or pink diamonds, making them less attractive as investment options.

Investing in colored diamonds typically starts in the million-dollar range per carat. A notable example is the record sale of the pink diamond “Pink Star,” which fetched an astounding $71.2 million USD. This sale highlights the premium prices that colored diamonds command, particularly red and blue diamonds, due to their extreme rarity.

Price Development for Investment

In 2023, the gemstone market reached an estimated value of approximately $32.38 billion USD, with a projected increase to $55.96 billion USD by 2033 (according to Future Market Insights). The rise in the price of colored gemstones can be attributed to several factors, such as an increasing number of individuals exploring alternative investment avenues, their scarcity as rare natural resources, their aesthetic appeal, and their historical significance across diverse cultures.

Overall, there is about a 25% growth increase per year on the value of gemstones with at least a 500% increase in the last 20 years for their value. Some particular stones, including the Red Spinels, Tourmaline Paraibas, and rubies, increased in price by 50% each year in the last 20 years. Some particular stones, such as Kashmir sapphires, Red spinels and Burmese rubies, have seen their price go up more than a 1000%.

Market prices have been moving only in one direction throughout the history of gemstones, with their value always increasing. Gemstone investment is seen as one of the most secure forms of investment since both value and rarity keep increasing throughout the years.